Buying your first home is an exciting milestone and comes with plenty of benefits, including tax breaks, the ability to build equity, and, of course, a place to truly call your own. That’s not to say that the process is easy. You have many things to consider, including your current finances and ability to make future payments, among other concerns. Here are the top five tips to get you through your first homebuying experience.

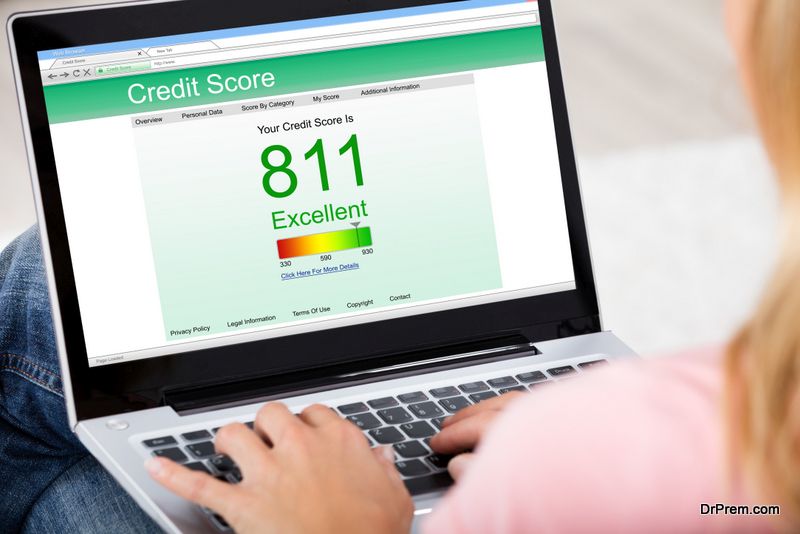

1. Check Your Credit

Before taking any other action, get a free credit report. You’re allowed one free credit report every year from each of three nationwide credit agencies. This gives you a chance to look over your debts, like a car loan or student loans. If your credit isn’t what you’d like it to be, you can work with a financial advisor on coming up with strategies to improve your score. You can look to taking out a personal loan from a private lender who will offer flexible repayment options. This is an easy way to come up with funds in order to pay off your existing balances and combine into one management payment. Not only will this result in an overall reduction in monthly expenses, but you’ll finally be on a path to finally eliminate debt.

2. Find the Right Real Estate Agent

Spend time understanding how to choose the right realtor, collaborating with the wrong real estate agent can lead to missed opportunities or, even worse, being stuck with a house you were pressured into buying. Do some research before working with an agent. Scope out their history and prior experience. Also, make sure that your style meshes well with a possible agent. Communication should be open and honest, and there should be no pressure at all.

3. Perform a House Inspection

Along with working with a real estate agent, you should also work with a home inspector who will perform thorough inspections of potential buys. Home inspectors look for major and minor defects alike, advise you on which items need to be repaired (if any), and which may need to be replaced down the line. A thorough home inspection can make the difference between a good buy and a terrible one.

4. Research Location

You always hear “location, location, location,” which is never more important than in real estate. While a house may look perfect, its location may not be ideal for your needs. Check out the neighborhood during both the day and night to check traffic, noise levels, and the general sense of safety. Could you see yourself being comfortable living here? Also, consider your commute and nearby shops and schools if you have children.

5. Think on a Long-Term Scale

Buying a house is not just about the budget you have now, but the budget of your future as well. Think of your long-term financial plan. While things may look good now, you could face financial hardships in the future, such as a job loss in the family. Will you be able to afford those payments? Thinking ahead can save you a lot of trouble.

Article Submitted By Community Writer